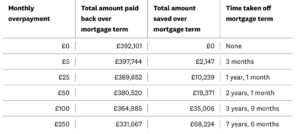

Overpaying by just £5 a month could shave over £2,000 off your mortgage.

Here at Bourne Estate Agents, we know that it is important to find the best mortgage deal to suit you, to ensure you get the best deal. Here is a hack that we have found, which will help lessen the financial burden of your mortgage repayments. Overpaying on your mortgage can indeed have a substantial impact on your long-term financial health. Here’s a breakdown of the potential savings and benefits of making regular overpayments on your mortgage, as shown in the table:

As demonstrated in the table, even relatively small monthly overpayments can lead to significant savings over the life of your mortgage. Here’s what these figures mean:

- Total Amount Paid Back: This is the total cost of your mortgage, including both the principal (original loan amount) and the interest paid over the mortgage term.

- Total Amount Saved: This is the amount you save in interest payments by making overpayments. The savings increase as your overpayment amount goes up.

- Time Taken Off Mortgage Term: Overpayments result in a reduced mortgage term, which means you’ll pay off your mortgage more quickly. The more you overpay, the more time you shave off your mortgage.

These calculations are based on a £200,000 mortgage with a 25-year term and an interest rate of 6.36%. It’s important to note that the actual savings may vary depending on the specific terms of your mortgage and the interest rate. In a high-interest environment, like the one mentioned, overpaying on your mortgage can be a financially savvy move, as it helps you pay down your debt faster and save on interest costs.

If you would like some advice about your mortgage payments, please feel free to contact one of our expert agents here at Bourne for a chat.

Sourced from Which.co.uk